This gym owner is risking it all for greater long-term wealth

What’s up Gym World?

Every week this year, I’ve talked to a gym owner who reached financial freedom. Most tend to do the same thing. They:

- Keep expenses low,

- Build one location that cash flows well, &

- Reinvest profits into:

And today, we’ll explore another route—becoming a franchisee.

Meet Greg Morrone

Greg runs The FIT Lab in Hoboken, NJ. His 2,000 sq ft gym makes $750k/yr in revenue with a healthy 6-figure profit.

It’s impressive, but Greg’s worried about the future. He knows that a career as a personal trainer isn’t a lifelong gig.

💡 Think about it: what does life look like in your 50s if you’re still on the gym floor?

Though running a gym that profits $100k+/yr is a huge accomplishment, it doesn’t get you far in the Northeast, especially if you’re trying to raise a family.

Greg wanted to be a multi-location gym owner, but he felt his chance of success was higher if he was running someone else’s playbook. That’s why he decided to open franchised gyms instead of more FIT Labs.

Greg plans to open 9 more Alloy locations in the next 5 years—an ambitious growth plan.

Using a franchise model like Alloy’s makes it easier to grow. Not many non-franchised gyms get past 4 or 5 locations. But even if you dream of owning 10+ locations one day, remember that franchising has its pros and cons:

| Drawbacks of Franchising | Attractive Points of Franchising |

|---|---|

| High upfront costs (franchise fees, build costs, etc.) | Proven business model (with the right franchise choice) |

| Sharing a percentage of revenue with the franchisor | Banks prefer lending to franchises over independent concepts |

| Limited control over your business model | Easier to get private capital |

Greg says this year has been one of the most stressful years of his life, but if his plan works, it’ll pay off big.

Here’s why:

Private Equity LOVES established franchises

Take this article on Planet Fitness:

Planet Fitness franchisees were at the center of an M&A frenzy prior to the pandemic. Seeing the attraction of recurring revenue, Ebitda margins between 20% and 30%, a fragmented market, and growing consumer awareness around health and wellness, private equity poured money into high-value, low-price fitness chains, which bundle additional services for low-cost gym memberships.

Basically, private equity (PE) loves investing in established fitness franchisees because of their recurring revenue and predictable earnings. Many fitness franchisees have built 8 figures of wealth selling to private equity, but the journey is tumultuous.

Private equity firms need to deploy a lot of money. They’re not interested in buying one or two gym locations; they want to buy a company with steady income and strong management.

There’s a lot of money to be made building up a small portfolio of franchised gyms. But here’s the catch: if you don’t have a ton of money, you’ll have a hard time getting approved by established franchises like Planet Fitness or Orangetheory—they’d rather award territories to private equity firms instead of Joe Blow gym owner.

The trick is being early to a good concept. Alloy started franchising in 2019. Greg knew Rick Mayo, the founder of Alloy, so he was able to get in early.

That said, being early comes with more risk because Alloy isn’t a national brand yet and the concept hasn’t been proven on a mass scale.

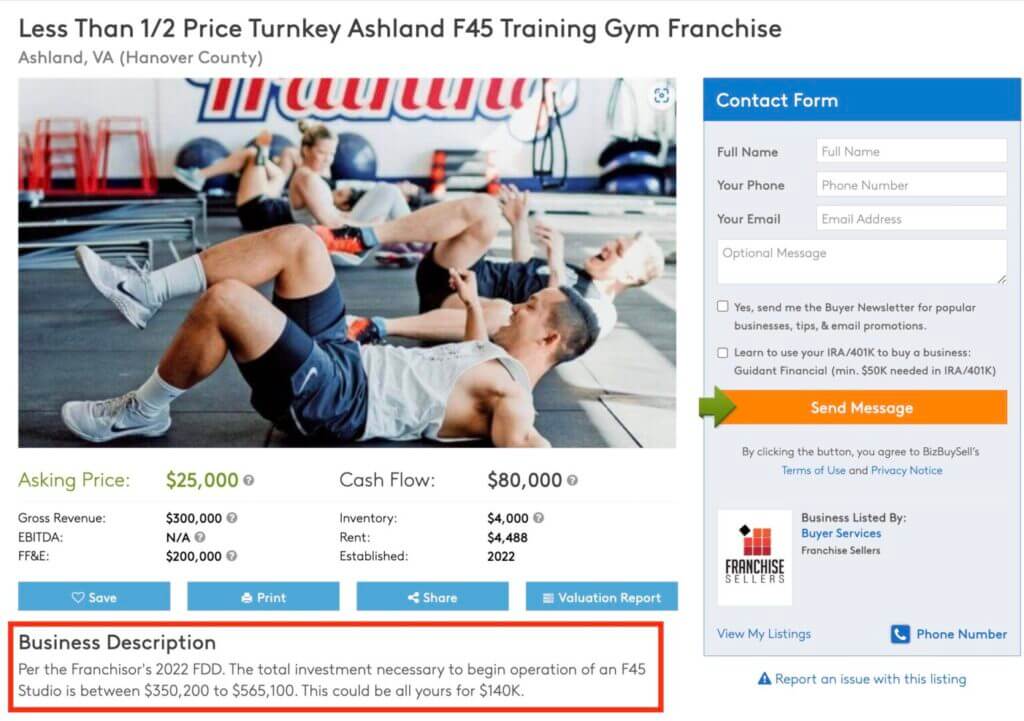

If the concept turns out to be a flop, Greg can lose a lot of money quickly. Just ask anyone who opened up a bunch of F45s over the last few years:

On the upside, if he:

- Grows with the concept,

- Opens more locations with other people’s money, &

- Increases earnings,

he’ll experience one of the greatest wonders of the business world: multiple expansion.

Here’s how it works:

A profitable business sells at a multiple of the annual earnings the owner takes out. For smaller gyms, that multiple is usually 2-4x, because the buyer is basically buying themselves a job.

So, a gym that makes $100k in earnings can be worth $200k-$400k.

If you increase the earnings, the multiple increases as well. If Greg gets to 10 locations and at least $1M+ in earnings, his business is worth 6-10x earnings, i.e. $6M-$10M+.

At that size, smaller private equity firms will be interested, and he can sell a chunk of the business to a private equity partner and get access to their:

- Expertise → some of the smartest people in the world work in private equity

- Money → they have better relationships with banks & lenders

Getting a private equity firm on board means you could grow your business faster. These firms work in cycles of 3-5 years with the goal of increasing earnings and then selling at a higher multiple to other private equity firms.

Again, these guys are investors—not operators. If you’re a good operator, they’ll want to keep you on and pay you handsomely if you perform.

💡 This is exactly how Jamie Weeks became the largest Orangetheory franchisee after selling to PE twice.

With the right moves, you could build serious wealth—we’re talking yacht, private jet, and vacation home level—in 10-15 years time.

So, what can gym owners do?

If you’re thinking about the franchise route, focus on two key things:

- Join a promising concept early

- Have enough cash to reach the earnings threshold that piques private equity’s interest

In Greg’s case, Alloy is a newer franchise. With fewer locations and less brand awareness, he has a better chance of securing more territory and helping refine their model.

For deeper insights, watch or listen to Greg’s interview on the latest Gym World.

Until next week,

j