Without taking on any additional risk…

What’s up Gym World?

Many gym owners view acquisitions as buying an existing space and turning it around.

While this strategy can save time and money upfront, it has its challenges:

- Changing an established culture for staff and members is tough.

- Sometimes, firing staff or members is necessary.

- Taking on a new lease can introduce liabilities, especially with a new landlord.

- If things don’t go smoothly, it can distract key staff from your core revenue-generating facility.

But there’s a different approach to acquisitions that mitigates these risks.

Daniel Davidson from CrossFit Main Line is running this play. After opening his third location, Daniel realized there was a better way grow his membership without the risks associated with opening new facilities.

He expanded by acquiring competitors at asset value and then merging their resources into his own gym— a strategy known as bolt-on acquisitions.

Here’s how:

Developing CrossFit Main Line

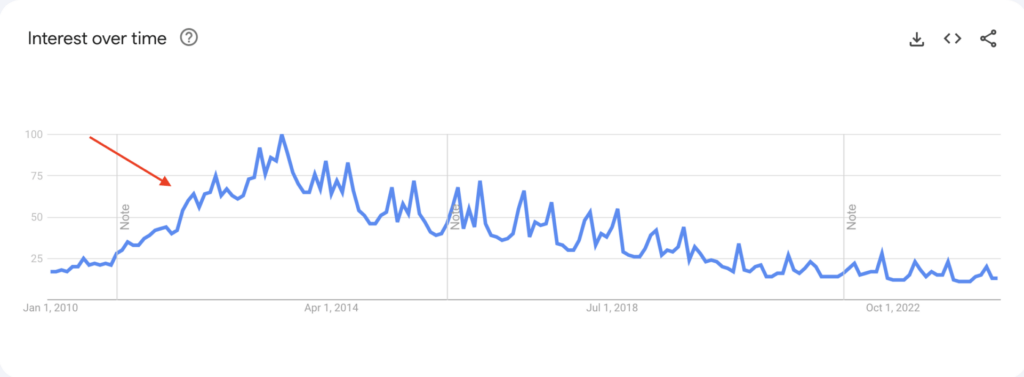

Daniel opened his first location in 2012 with 100 members at launch. This was the perfect time to open a CrossFit gym in the U.S.

Riding this wave of luck and success, he opened a second location a year later, which also launched with over 100 members.

💡 In 2013, I got 120 members to sign up at my first gym and 210 members at my second gym before I opened the doors.

At the time, the gyms were packed without formal systems or processes. Daniel quickly realized the potential liabilities and knew he needed to sort things out. So, he hired business coaches and joined mentorship groups to improve operations.

Opening the third location

Like most experienced entrepreneurs, Daniel spent years refining his gyms. When COVID hit, he found himself in discussions with other struggling gym owners who consistently asked:

- What are you doing in your business that’s working?

- What’s not working?

And though Daniel hadn’t planned on expanding, these conversations pushed the idea of acquiring a struggling gym. He knew exactly what to do to make a gym succeed and what pitfalls to avoid to save costs, including:

- Hiring a good team

- Implementing marketing, CRM, and client value systems

- Establishing member contracts

So, Daniel bought his third location from a couple whose business partners wanted out, and he doubled the gym’s gross revenue within a year by implementing the right systems.

💡 CrossFit Main Line locations are under 5,000 sq ft and only offer group training. They have over 200 members per gym, with an average client value of $175 per month.

Each gym runs 4-5 classes a day for 16-20 members per class. Each is managed by one full-time staff and has about a 35% profit margin.

Growing through bolt-on acquisitions

Many gym owners underestimate the value of asking competitors questions.

Daniel strategically visited gyms in his area with his team, asking each owner the same two questions: What’s working and what’s not in your business? These conversations helped build relationships and often revealed owners who were:

- Burnt out

- Unable to rebuild their gym

- Ready to sell

💡 Deliberate networking is one of the smartest things you can do, especially if you’re looking to expand or grow your business.

When Daniel looked for gyms to acquire, he checked whether they had:

- Full-time staff who can run the gym without the owner

- Systems for attracting and retaining members

- Established member contracts

He learned from a business broker that these elements dictate a gym’s earnings. Ideally, Daniel looked for gyms missing all three because if they weren’t profitable, he could acquire them for the value of their assets—members, coaches, and equipment.

💡 Gyms sell at a multiple of the annual earnings the owner takes out, and this multiple is determined by the quality of the business. Here are some factors that smart buyers consider.

For example, a gym making $50k in profit could be valued as follows:

With staff, can be worth 1x ($50k) With staff and systems, can be worth 2x ($100k) With staff, systems, and members under contract, can be worth 3x ($150k)

The more established a business is, the more it’s worth.

Daniel then checked whether the lease was signed by the business or the owner. Leases without owner liability are easier to exit once the business gets sold.

When Daniel found a gym that met his criteria, he proposed merging its assets into his business—also known as built-on acquisitions. He offered the owner:

- Higher pay and fewer work hours at his gym

- Money for their equipment

- A commission on members they brought over in the first year

- Assurance that their members had a place to continue training

💡 Life Time is doing similar acquisitions.

This strategy solves common challenges that growth-oriented gym owners face like:

- Finding and retaining talent

- Managing risk

- Handling the complexities of acquisitions

The key is knowing what you want and leveraging your network.

Gym owners: here are my thoughts

Regardless of whether you want to expand, there’s a lot to learn from Daniel.

Many gym owners don’t pay enough attention to protecting their downside, but Daniel has creatively used his network to find ways to reduce risks when growing his gym.

If you’re thinking about expanding, be more cautious and protect your business. But remember, the industry is small and people talk. If you’re too one-sided in your approach, it could limit your opportunities down the road.

To learn more about Daniel’s business, watch or listen to his full interview on Gym World.

until next week

j